The Australian Governments planned initiative will only prolong Australia’s economic recovery.

In the 4th quarter of 2008 the Australian Government announced a $10.4 Billion spending program to stimulate the economy, but in reality this was only a policy to buy votes and the confidence of Australian that don’t know better.

Evidence to date by the Australian National Retailer Association (ANRA) indicates that consumers used the bulk of their one-off payments to paydown debt, with little on Christmas spending. Executives of retail chains are stating that the stimulus only provided a short term boost to the economy. A similar stimulus package was used by the USA Government in 2008 in the form of a tax rebate individuals – having the same economic effect of only short term stimulus.

The reasons for failure in the lack of policy and efficiency targeting in the governments policy can be backed by simple 2nd year University economics.

Aggregate expenditure & Multipliers are not the economic theory to end all theories, as they ask us to assume a closed economy, laissez-faire capitalism & price-wage inflexibility – but asked to simplify our assumptions.

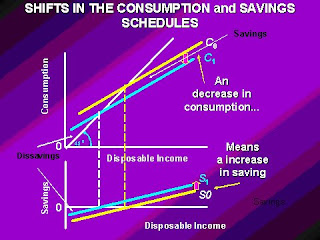

Low income earners such as people on welfare have limited ability to save, but as income increases the option to save or pay off debt increases.

Australia would have been better place to recover from the down turn in the economy with an additional Federal Government Budget surplus had it dropped the additional bonus paid to families and pensioners. The government should have focused on paying additional money to people on welfare in the form on increased rental assistance.

The additional rental assistance has the benefit of a payment policy that can be for filled its objective of assisting low income earner with high rental price throughout Australia. Secondly this policy of increase rental assistance can be reduced further into the future.

But at the end of the day what would I know, I didn't study politics.

No comments:

Post a Comment